Acquisitions and Divestments

Overview

At inGauge Energy, we provide expert guidance and strategic support to companies navigating acquisitions and divestments in the energy sector.

Our tailored solutions empower businesses to make informed decisions, mitigate risks, and maximise value during transactions.

Lorem ipsum dolor sit amet consectetur adipiscing elit. Quisque faucibus ex sapien vitae pellentesque sem placerat. In id cursus mi pretium tellus duis convallis. Tempus leo eu aenean sed diam urna tempor. Pulvinar vivamus fringilla lacus nec metus bibendum egestas. Iaculis massa nisl malesuada lacinia integer nunc posuere.

What we do

Whether you’re conducting due diligence, evaluating technical and economic factors, or seeking robust economic modelling, our team is here to support your goals.

With a deep understanding of the energy market and enviable track record, we bring a comprehensive approach that simplifies the transaction process and supports smarter decision making based on hands-on experience of knowing how and what it takes to bring opportunities to fruition.

Why us?

With extensive experience in the oil and gas sector, our team offer deep technical expertise, industry knowledge, hands on experience and a thorough understanding of the complexities surrounding acquisitions and divestments in the oil and gas space. Our collaborative approach ensures you receive the highest quality analysis and insights to support confident, well-informed decisions.

We’re real world practitioners. Our people have worked on the ground and in the field, delivering real-world results across exploration, production, compliance, and project delivery. This operational insight allows us to see what others miss to identify hidden risks, uncover opportunities, and offer advice with insight and experienced.

We tailor every engagement to your context, providing due diligence, technical evaluations, and economic models that are relevant and accurate.

Whether you’re evaluating a new acquisition, preparing for divestment, or considering portfolio optimisation, we simplify the process and support informed decisions grounded in pragmatism.

By building this expertise in-house, our clients benefit from:

- Technical plans that align with engineering designs

- Regulatory compliance handled by experts

- Lower costs and less rework

- Faster project delivery

- Minimal third-party related delays

Whether you’re evaluating a new acquisition, preparing for divestment, or considering portfolio optimisation, we simplify the process and support informed decisions grounded in pragmatism.

What we've done

Whether you’re conducting due diligence, evaluating technical and economic factors, or seeking robust economic modelling, our team is here to support your goals. With a deep understanding of the oil and gas market and enviable track record, we bring a comprehensive approach that simplifies the transaction process and supports smarter decision making based on hands-on experience of knowing how and what it takes to bring oil and gas opportunities to fruition.

Our Achievements

- Achievement item

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Achievement item

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Achievement item

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Achievement item

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Supporting better transactions

Initial Assessment

Opportunity identification and strategic fit

Due Diligence

Financial and operational risks and gaps

Technical Evaluation

Technical risk exposure and performance

Economic Modelling

ROI / OPEX / CAPEX and value projections

Decision Support

Risk mitigation and strategic insights

Our Core Services

Our initial assessment phase focuses on identifying strategic opportunities and determining the suitability of potential assets for acquisition or divestment. We work closely with clients to align opportunities with business objectives, evaluate portfolio fit, and highlight key value drivers early in the process.

Key services include:

- Opportunity screening and qualification

- Strategic alignment and business fit analysis

- Preliminary technical and economic review

- Stakeholder and regulatory landscape scan

- Identification of key risks and value levers

Our Due Diligence process thoroughly examines all aspects of a potential acquisition or divestment, ensuring a clear understanding of the risks and opportunities involved. We identify hidden liabilities, assess operational capabilities, and evaluate financial and legal implications.

Key services include:

- Financial and operational assessments

- Environmental, health, and safety considerations

- Regulatory compliance checks

- Market and competitive analysis

- Risk identification and mitigation

Our technical evaluation provides a detailed analysis of assets and operations, ensuring a comprehensive understanding of technical value and operational performance, assessing the feasibility, production potential, and technical risks associated with oil and gas assets.

Key services include:

- Evaluation of HSE standards and systems

- Reservoir engineering and production assessments

- Infrastructure evaluation and lifecycle analysis

- Asset optimisation strategies

- Exploration and development assessment

- Technical risk assessment and mitigation

We develop tailored economic models that provide a comprehensive view of the financial implications of acquisitions and divestments. By integrating key data points, we create models that support informed decision-making, helping you understand the value, return on investment, and financial risks involved.

Key services include:

- Financial forecasting and scenario analysis

- Capital expenditure (CAPEX) and operational expenditure (OPEX) modelling

- Sensitivity analysis and economic risk assessments

We provide end-to-end strategic support throughout the transaction process, enabling clients to make confident, well-informed decisions. Drawing on technical, commercial, and regulatory expertise, we help mitigate risk, optimise value, and provide clear, actionable insights to guide your investment or divestment strategy.

Key services include:

- Risk mitigation strategies and scenario planning

- Regulatory and stakeholder engagement support

- Portfolio optimisation recommendations

- Board and executive decision support

Initial Assessment

Our initial assessment phase focuses on identifying strategic opportunities and determining the suitability of potential assets for acquisition or divestment. We work closely with clients to align opportunities with business objectives, evaluate portfolio fit, and highlight key value drivers early in the process.

Key services include:

- Opportunity screening and qualification

- Strategic alignment and business fit analysis

- Preliminary technical and economic review

- Stakeholder and regulatory landscape scan

- Identification of key risks and value levers

Due Diligence

Our Due Diligence process thoroughly examines all aspects of a potential acquisition or divestment, ensuring a clear understanding of the risks and opportunities involved. We identify hidden liabilities, assess operational capabilities, and evaluate financial and legal implications.

Key services include:

- Financial and operational assessments

- Environmental, health, and safety considerations

- Regulatory compliance checks

- Market and competitive analysis

- Risk identification and mitigation

Technical Evaluation

Our technical evaluation provides a detailed analysis of assets and operations, ensuring a comprehensive understanding of technical value and operational performance, assessing the feasibility, production potential, and technical risks associated with oil and gas assets.

Key services include:

- Evaluation of HSE standards and systems

- Reservoir engineering and production assessments

- Infrastructure evaluation and lifecycle analysis

- Asset optimisation strategies

- Exploration and development assessment

- Technical risk assessment and mitigation

Economic Modelling

We develop tailored economic models that provide a comprehensive view of the financial implications of acquisitions and divestments. By integrating key data points, we create models that support informed decision-making, helping you understand the value, return on investment, and financial risks involved.

Key services include:

- Financial forecasting and scenario analysis

- Capital expenditure (CAPEX) and operational expenditure (OPEX) modelling

- Sensitivity analysis and economic risk assessments

Decision Support

We provide end-to-end strategic support throughout the transaction process, enabling clients to make confident, well-informed decisions. Drawing on technical, commercial, and regulatory expertise, we help mitigate risk, optimise value, and provide clear, actionable insights to guide your investment or divestment strategy.

Key services include:

- Risk mitigation strategies and scenario planning

- Regulatory and stakeholder engagement support

- Portfolio optimisation recommendations

- Board and executive decision support

Our Capabilities

inGauge brings unparalleled expertise across well engineering, environmental compliance, and lifestyle project delivery.

Learn more

Beetaloo Basin, NT

At the frontier of Australia’s energy future.

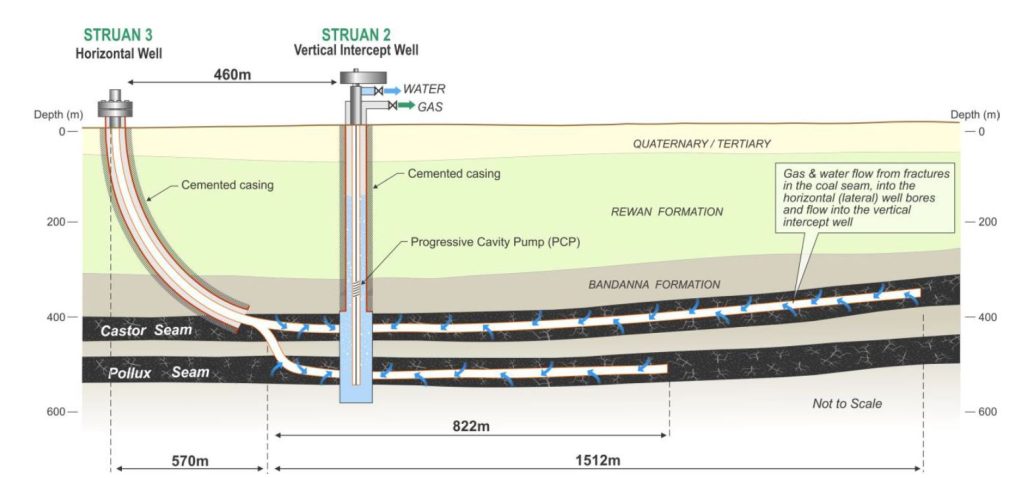

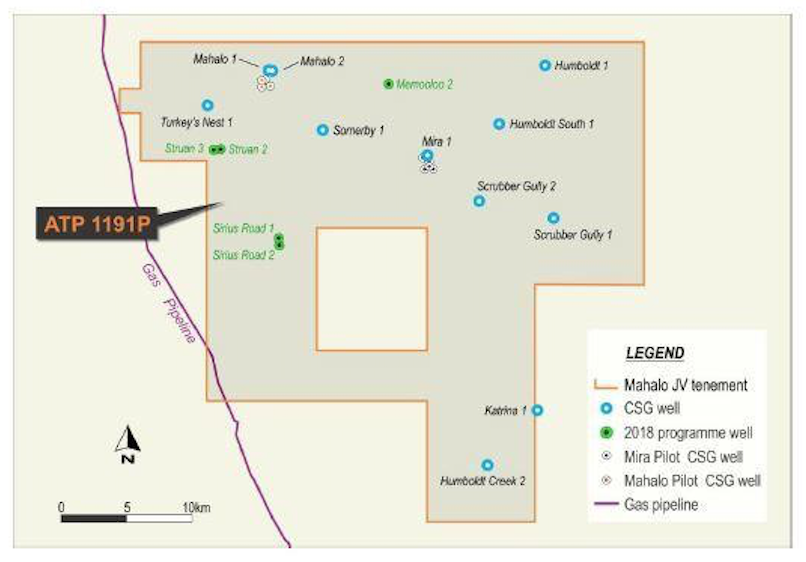

Taroom Trough

The team you need to deliver measurable results.

Decommissioning

Trusted by government and industry to decommission assets.

Alternative energy & emissions reduction

Leading alternative energy and emissions reduction projects.

CSG

Decades of experience, thousands of wells, in every basin.

Related Projects

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.